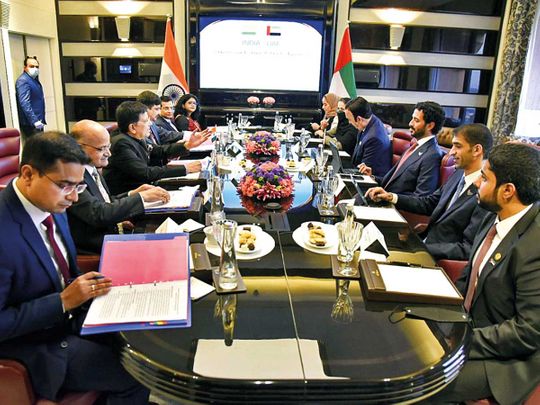

UAE Minister of Economy Abdulla bin Touq Al Marri and Piyush Goyal, Indian Minister of Textiles, Minister of Commerce and Industry and Minister of Consumer Affairs, Food and Public Distribution on the occasion of signing Comprehensive Economic Partnership Agreement between the two nations.

Dubai: The UAE and India have signed a trade and economic partnership that will remove 80 per cent of the customs tariffs on goods produced and shipped out from the countries. The other 20 per cent will be phased out over time, and sets up a trade alliance that could touch $100 billion in the next five years from $60 billion plus now.

The deal, called the Comprehensive Economic Partnership Agreement (CEPA), was signed in the virtual presence of His Highness Sheikh Mohamed Bin Zayed Al Nahyan, Crown Prince of Abu Dhabi and Deputy Supreme Commander of the UAE Armed Forces, and Prime Minister Narendra Modi of India.

This agreement, which is considered the first of its kind, is among the economic projects that the UAE has set out for the next 50 years,” said Sheikh Mohamed. “This provides a strong basis for the continuous expansion of our common interest for the benefit of our people and for the fulfilment of their aspirations and better prosperity.”

UAE-led investments into India will translate into millions of new jobs, such as in the plastics industry which will also benefit from technology support.

You are celebrating 50 years of the formation of UAE and you have also defined a vision for the coming 50 years for UAE. India also is celebrating 75 years of its independence in the form of a festival and we have set an ambitious target for the coming 25 years. There are several similarities in the future vision of both countries.

– Prime Minister Narendra Modi

A ‘reliable partner’

In his statement, Prime Minister Modi said: “Trade, investment, energy, and people-to-people contacts have been the pillars of our cooperation. At the same time, there are possibilities of enhancing cooperation in several new areas.

“The new MoU between us on food corridors is a very good initiative. We welcome investment from UAE in the areas of food processing and logistics. With this, India can become a reliable partner for UAE’s food security.

Effective from May 1

The CEPA deal, which is the first trade deal entered into by India’s BJP-led NDA government, will formally take effect from early May, once the internal processes are completed in either country, according to Piyush Goyal, India’s Minister of Commerce and Industry.

The deal, details of which are still to come out in full, will provide the big banh needed for trade between UAE and India to move up a few gears. That up to 80 per cent of the goods traded will be covered under tariff concessions does push the possibilities for an immediate and significant spike in volumes.

On the areas that are not covered by the deal – the 20 per cent – Goyal said that these are areas of strategic interests to both countries and will require time for the duty structures to be rolled back.

Spread the word

India has invited top UAE Government officials in the first week of May to have round-table discussions with the country’s business community and get the word out on what CEPA could deliver as a win for all parties.

In his speech, Modi said: “Last year, alone India has seen the emergence of 44 unicorns. We can encourage startups in both of our countries by way of joint incubation and joint financing. Similarly, we can cooperate in modern institutions of excellence for the development of skills for our people.”

With CEPA, the “sky is the limit” for the UAE and India to achieve their ambitions and share in them.

India, UAE seal ‘historic deal’ and here’s what UAE businessmen have to say

UAE-based businessmen hail the CEPA agreement signed on Friday

Dubai: India and UAE ‘sealed’ a historic deal that will boost bilateral trade from the current $60 billion to $100 billion in the next 5 years.

The agreement will provide significant benefits to Indian and UAE businesses, including enhanced market access and reduced tariffs.

The Indian delegation was led by Union Minister of Commerce and Industry Piyush Goyal, while the UAE delegation was led by Abdullah Bin Touq, UAE Minister of Economy, Dr. Thani Bin Ahmed Al Zeyoudi, UAE Minister of State for Foreign Trade

The impact of ‘the 881 page’ trade agreement will be felt in select sectors, with energy, manufacturing gold and jewellery, and pharmaceuticals expected to figure prominently. It is felt that the full benefits of the duty exemptions and cuts will then be extended to other sectors as the CEPA benefits flow wider.

Could this also be the platform for UAE-India alliances to think beyond traditional sectors?

No doubt, many new avenues of collaboration will open, and this will benefit businesses from both countries and beyond, as UAE is a key gateway to the entire Middle East and Africa.

– Yussufali M.A., Chairman of LuLu Group and Vice-Chairman of Abu Dhabi Chamber of Commerce

Healthcare

In the months leading up to the deal being announced, there was speculation build up whether healthcare and pharmaceuticals would have an elevated status in the trade and investment flows.

“It may be difficult for new entrants from India to build a presence in the UAE, because this sector is saturated in terms of capacity,” said Dr. Azad Moopen, Chairman and Managing Director of Aster DM Group, which apart from its hospitals and clinics in the UAe has also invested around Rs30 billion on its in-India network.

Funding from UAE in India’s Tier 2/3 cities

According to him, healthcare investments from the UAE to India would make better sense. “India’s healthcare space is still struggling with capacity needs,” Dr. Moopen said. “If the UAE could consider some of its planned India funds into developing healthcare facilities in Tier 2 or Tier 3 cities, it could ease capacity constraints. If these funds can be provided on preferential terms, it would be even better.”

Medical education

There have been some attempts in the past to rope in Indian expertise in the medical education field into the Gulf. Faculty-level alliances were mentioned as possibilities, but nothing much came of them.

Now, with all the pandemic lessons fresh in everyone’s minds, the CEPA deal could be used to revive those efforts.

Medical education – and more of it – is a requirement for UAE and GCC countries. Capacity needs to be built immediately and significantly.

– Dr. Azad Moopen

“This is a space ideal for Indian investors with the right credentials to tie up with healthcare investors or government schemes to build the medical colleges for the UAE and GCC’s future. The next generation of talent for the healthcare sector needs to be home-grown. It’s as important as adding hospitals and clinics.”

Market opportunities

Rizwan Sajan

Rizwan Sajan

According to Rizwan Sajan, Chairman of Danube Group, the CEPA deal will bring about a shift in NRI investment attitudes – of looking at both UAE and India as equal opportunity markets. “We are more than ready to fill the gap and tap into opportunities in India – be it in real estate, construction, energy, infrastructure, healthcare or retail,” he said. “Many of us – NRI entrepreneurs who made it big in the UAE – would now like to expand into the growing Indian market and help our economy by investing and creating jobs.”

“The easing of duties will cement UAE’s status as a ‘jewellery gateway’ to the world and replacing the likes of Hong Kong and Italy,” said Shamlal Ahamed of Malabar Gold & Diamonds.

This development will make the pricing of Indian manufactured jewellery even more attractive to shoppers – residents, transit arrivals, and tourists – in the UAE.

– Shamlal Ahamed

Ease shipping costs

The duty exemptions will work to the advantage of importers in both countries. The CEPA deal will extend tariff concessions to up to 80 per cent of the goods that make up the trade volumes between the countries.

“In the recent past there had been a tremendous increase in shipping freight charges for goods from India,” said Dr. Dhananjay Datar of Adil Trading. “On this historic occasion, these issues have been addressed and reasonable solutions provided.”

As an exporter of Indian foodstuffs, any reduction in shipping and customs costs will pave the way to India becoming the largest trade partner of this country.

– Dr. Dhananjay Datar

Duty-free exemptions to Indian exports

Based on the latest figures, UAE investments in India is around $17 billion or so, of which $11.67 billion is in the form of foreign direct investment. The rest of the fund inflow into India UAE is as portfolio investments. This makes the UAE the ninth biggest source of FDI for India.

In the last two years, UAE sovereign wealth funds have gotten real busy in this space, most notably raising their exposure in Reliance Industries of Mukesh Ambani.

The historical trade agreement is going to open up many vistas of growth for the countries and for bilateral trade to reach a handsome $100 billion. The volumes have already touched $60 billion – that itself shows the confidence level. Today’s deal is just the formalization of a meeting of the minds that has already been there for decades.

– Ram Buxani, Chairman of ITL Cosmos Group.

According to Raju Menon, Chairman and Managing Partner of the audit firm Kreston Menon, the UAE-India CEPA sign-off will set the template for India’s other upcoming trade deals.

“These are partnerships done with an eye on the future,” he said. “The UAE and India are also aiming to strengthen their partnership in start-ups, fintech, AI, security and renewable energy.

The UAE will be keen to invest in ports, railways and the industrial corridors in India. The fact that almost 80 per cent of India’s exports to UAE will be duty-free is the biggest advantage.

– Raju Menon

Eliminating trade barriers

“The bilateral partnership deal was done with the objective of eliminating trade barriers and deepening economic linkages between the UAE and India,” said Nasheeda of Nishe Accounting and Consulting. “it can only work wonders for both. Among other things, the agreement would reduce or eliminate customs tariffs and simplify trading procedures, while affording sufficient protection to domestic industries.

While India is one of the world’s largest food producers, it is not amongst the largest food exporters. An enhanced trade relationship with India will contribute to the UAE’s quest to achieve food security while helping boost India’s exports. The deal promises India a gateway to markets in West Asia and Africa.

CEPA deal: India’s gold, jewellery sector and pharmaceutical firms to benefit from easier access for UAE approvals

Dubai: India’s gold and jewellery sector as well as the pharmaceutical industry have emerged major winners in the new deal struck by the UAE and India, which seeks to raise trade volumes between the countries to $100 billion. Apart from the trade aspect, the Comprehensive Economic Partnership Agreement (CEPA) will free up investments – and create job opportunities – in key sectors.

In the gold and jewellery sector, India will benefit from easier access to the UAE, helped by changes to the customs duty. It will mean that India-made jewellery can be brought to the UAE at competitive rates. Currently, the UAE has an import duty of 5 per cent on these items.

“The easing of duties will cement UAE’s status as a ‘jewellery gateway’ to the world and replacing the likes of Hong Kong and Italy,” said Shamlal Ahamed of Malabar Gold & Diamonds. “This development will make the pricing of Indian manufactured jewellery even more attractive to shoppers – residents, transit arrivals, and tourists – in the UAE.

Landmark move on medicine imports

This opens up significant prospects for India’s pharmaceutical companies, who typically make generic medicines at much lower retail prices than the originals.

Steel will shine

Steel manufacturers in the UAE and India will have their reasons to be pleased. Their exports of value-added products to either country will come under the duty concession regime.

India’s sprawling plastics industry gets a chance to generate “35-40 lakh” (3.5 million to 4 million) jobs as it benefits from UAE provided investments and technology knowhow.

Done deal

According to Goyal, the CEPA deal “is not an interim arrangement or an interim agreement. It’s a complete and comprehensive economic partnership, finalized in the shortest possible time that any such comprehensive agreement anywhere in the world has been witnessed in history.

“Ever since 2017, when both countries embarked on a comprehensive strategic partnership covering a wide array of subjects, we have been witnessing a growing synergy between the two countries and a deepening of the bonds of brotherhood between the people of the two countriesUPDATE

As it happened: UAE-India sign historic trade deal, what top NRI businessmen think about it

One million job opportunities will be created with UAE-India trade deal: Indian minister

The CEPA (Comprehensive Economic Partnership Agreement) between the UAE and India is set to further strengthen the existing $60 billion plus trade relationship between the countries. The deal was signed during a virtual summit in the presence of His Highness Sheikh Mohamed Bin Zayed Al Nahyan, Crown Prince of Abu Dhabi and Deputy Supreme Commander of UAE Armed Forces, and Narendra Modi, Prime Minister of India.

Check out the updates with comments from top Indian businessmen here:

60 days to come into effect

CEPA confirmation in both countries will probably take 60 days – May 1 could be when the CEPA comes into effect, says Piyush Goyal, Indian Minister of Textiles, Minister of Commerce and Industry and Minister of Consumer Affairs, Food and Public Distribution.

Both countries have made duty “concessions”, said the Indian minister. “It’s a very balanced agreement…” he said.

Sensitive goods

While 80 per cent of goods will get tariff concessions, the remaining 20 per cent remain protected because these are “sensitive to both countries”. But even then, some of these could still see duty removals in a phased manner, the Indian minister said.

India to host UAE officials

India will host UAE Government officials for round-table meetings with businesses in the country, said Goyal. This would be in the first week of M

Ease shipping costs across the board

The duty exemptions will work to the advantage of importers in both countries. The CEPA deal will extend tariff concessions to up to 80 per cent of the goods that make up the trade volumes between the countries.

“In the recent past there had been a tremendous increase in shipping freight charges for goods from India,” said Dr. Dhananjay Datar of Adil Trading. “On this historic occasion, these issues have been addressed and reasonable solutions provided. As an exporter of Indian foodstuffs, any reduction in shipping and customs costs will pave the way to India becoming the largest trade partner of this country,” he said.

Gold and jewellery sector to benefit

Gold and Jewellery sector of India will be a major beneficiary from CEPA.

Crucial to steel sector

CEPA deal also extends to steel production and exports, freeing the industry from any “unnecessary surcharges”, says Piyush Gyal, Indian Minister of Textiles, Minister of Commerce and Industry and Minister of Consumer Affairs, Food and Public Distribution.

According to Bharat Bhatia, Founder & CEO of Conares, which has steel mills in Dubai, “The trade agreement between the UAE and India would massively benefit that steel and other metal commodity trade exploring the best opportunities to develop between the two countries. As I understand the steel manufacturers in both countries will be benefited helping them build a healthier and long-term relations. The current duties in the UAE customs are 5 per cent and on some products, it is 15 per cent.

“Trade agreements like the CEPA facilitate further investments between the two countries which benefits everyone. We have plans to explore the possibility of investing backward integration in steel making in India. This new trade deal between the two nations creates new opportunities for us to expand our footprint in India.”

One million jobs

There will be “one million job opportunities” as the CEPA deal pushes UAE-India trade to $100 billion, says minister Piyush Goyal.

Duty changes

Up to 80 per cent of goods will see duty changes as a result of UAE-India CEPA deal. The deal will take bilateral trade past $100 billion in 5 years, says UAE Minister of Economy Abdulla bin Touq Al Marri.

“This will lead to a stable trade environment…” he added.

Momentous chapter

“UAE and India are entering a momentous chapter in our shared history,” says UAE Minister of Economy Abdulla bin Touq Al Marri. “India was the first country we reached out to,” for resetting trade alliances in a changing global economy, says Minister.

Commemorative stamp issued

A commemorative stamp is being issued by the leaders of the UAE and India.

‘A shared vision of future prosperity for all posterity’ – that seems to be the main theme the CEPA deal is delivering. With emphasis.

Mutual take-off

India and UAE are poised for a ‘mutual take-off’ and create hundreds of thousands of jobs with the CEPA deal.

These are the targets – $100 billion in trade of goods and $15 billion via services.

Narendra Modi speaking at virtual summit

Entering a golden era- Piyush Goel

UAE-India sign the deal

Piyush Goyal signed the CEPA deal with the UAE Minister of Economy, Abdulla Bin Touq. This culminates a journey that began in 2015 with the visit of Prime Minister Modi to the UAE.

Medical education – why not?

There have been some attempts in the past to rope in Indian expertise in the medical education field into the Gulf. Faculty-level alliances were mentioned as possibilities, but nothing much came of them.

Now, with all the pandemic lessons fresh in everyone’s minds, the CEPA deal could be used to revive those efforts. “Medical education – and more of it – is a requirement for UAE and GCC countries,” said Dr. Moopen. “Capacity needs to be built immediately and significantly.

“This is a space ideal for Indian investors with the right credentials to tie up with healthcare investors or government schemes to build the medical colleges for the UAE and GCC’s future. The next generation of talent for the healthcare sector needs to be home-grown. It’s as important as adding hospitals and clinics.”

Will India’s healthcare get the full treatment from CEPA?

In the months leading up to the deal being announced, there was speculation build up whether healthcare and pharmaceuticals would have an elevated status in the trade and investment flows.

Funding from UAE in India’s Tier 2/3 cities

According to him, healthcare investments from the UAE to India would make better sense. “India’s healthcare space is still struggling with capacity needs,” Dr. Moopen said. “If the UAE could consider some of its planned India funds into developing healthcare facilities in Tier 2 or Tier 3 cities, it could ease capacity constraints. If these funds can be provided on preferential terms, it would be even better.”

Duty-free exemptions to Indian exports

Based on the latest figures, UAE investments in India is around $17 billion or so, of which $11.67 billion is in the form of foreign direct investment. The rest of the fund inflow into India UAE is as portfolio investments. This makes the UAE the ninth biggest source of FDI for India.

In the last two years, UAE sovereign wealth funds have gotten real busy in this space, most notably raising their exposure in Reliance Industries of Mukesh Ambani.

“The UAE will be keen to invest in ports, railways and the industrial corridors in India. The fact that almost 80 per cent of India’s exports to UAE will be duty-free is the biggest advantage.”

05:15PM

Yesterday

What will be different

Immediate impact

The immediate impact of the CEPA agreement will be felt in select sectors, with energy, manufacturing gold and jewellery, and pharmaceuticals expected to figure prominently. It is felt that the full benefits of the duty exemptions and cuts will then be extended to other sectors as the CEPA benefits flow wider.

Could this also be the platform for UAE-India alliances to think beyond traditional sectors?

No doubt, many new avenues of collaborations will open, and this will benefit businesses from both countries,” said Yussufali M.A., Chairman of LuLu Group and Vice-Chairman of Abu Dhabi Chamber of Commerce. “And even beyond as UAE is a key gateway to the entire Middle East and Africa.”

This is the theme that Indian businessmen based in the UAE are talking up – that if India’s manufacturing base needs to tap new markets in a most cost efficient manner, then doing so through the UAE provides the best route.

“DP World operates some of the key ports in India – so, from a factory in India to shipping it out to a client anywhere in the world becomes a possibility,” said a senior source in the logistics business. “The pandemic has shown the need to think different about supply chains. And Indian manufacturers should also consider UAE as the springboard for a much wider marketplace, and not just the other Gulf markets.

What is the wider goal of the deal?

Develop the trade relationship into a $100 billion status – and even go all the way to $115 billion – in the next five years. India is currently the third biggest trade partner for the UAE, and it is felt that with the new deal, there will be a scaling down of import duties to improve ease of access of goods and services.

Ahead of the CEPA deal being signed, Abdullah Bin Touq, UAE Minister of Economy, Dr. Thani Bin Ahmed Al Zeyoudi, UAE Minister of State for Foreign Trade, and Piyush Goyal, Minister of Commerce and Industry in the Indian Government, will deliver opening remarks.

For India, this is the first trade deal signed by the NDA Government, which is now working on multiple CEPA-linked alliances with key trade partners, including the UK. India will be aiming for progress in shipping more of its pharmaceutical products – leveraging its manufacturing strengths in generic medicines – to the UAE.

The deal, according to trade analysts, will set up a windows of opportunity for anything with a ‘Made in India’ stamp. For the UAE, it would mean having a partner that could play a fairly integral part to the country’s ambition ‘Operation 300Bn’ industrial progamme.

The deal will officially come into effect from April, 2022.

Thousands of cars including Audis, Porsches adrift on burning cargo ship in the Atlantic

22 crew members aboard were successfully evacuated, left the ship unmanned and adrift

Lisbon: The Felicity Ace, a massive Panama-flagged cargo ship carrying thousands of Volkswagen Group vehicles, caught fire near the Azores islands in the Atlantic Ocean Wednesday afternoon.

The ship’s 22 crew members were successfully evacuated and taken to a local hotel by the Portuguese Navy and Air Force, who were deployed to help with the rescue effort, according to a statement from the Navy. The ship itself was left unmanned and adrift.

An internal email from Volkswagen’s US operations revealed there were 3,965 Volkswagen AG vehicles aboard the ship. Headquartered in Wolfsburg, Germany, the group manufactures vehicles under brands including Volkswagen, Porsche, Audi and Lamborghini “- all of which were in tow when the vessel set ablaze.

More than 100 of those cars were headed for the Port of Houston in Texas, with GTI, Golf R, and ID.4 models deemed to be at risk, according to the email. The auto industry is already struggling with supply issues, including pandemic-related staffing woes and the global chip shortage.

Luke Vandezande, a spokesperson for Porsche, said the company estimates around 1,100 of its vehicles were among those on board Felicity Ace at the time of the fire. He said customers affected by the incident are being contacted by their dealers. “Our immediate thoughts are of relief that the 22 crew of the merchant ship Felicity Ace are safe and well,” Vandezande said.

It’s not the first time the manufacturer has lost merchandise at sea. When the Grande America caught fire and sank in 2019, more than 2,000 luxury cars, including Audis and Porsches, sank with it.

Some customers expressed their disappointment on social media. One Twitter user reported his custom spec’d Porsche Boxter Spyder was on board the ship. Standard models of the vehicle start around $99,650.

A spokesperson for Lamborghini’s U.S. operation declined to comment on the number of cars the company had on board or which models were affected, but said that they are in contact with the shipping company to get more information about the incident.

Felicity Ace is roughly the size of three football fields and was en route to a port in Davisville, Rhode Island, when a distress signal was issued due to a fire on one of its cargo decks.

As of Wednesday night, the ship’s owner was arranging for the vessel to be towed, the Navy said. They plan to remain on site to monitor the situation, reporting no detectable traces of pollution so far.

If deep in debt, shouldn’t ‘settlement loans’ help? Not necessarily, experts say

Why agreeing on a debt settlement with your creditor should be your last resort

Dubai: It’s often considered the last resort of a person deep in debt to settle his or her dues by negotiating and agreeing with the creditor to accept less than the amount owed as full payment.

If you’ve been falling deeper into debt, you’ve also been frequently contacted by debt collectors seeking a timeline on when you will pay your outstanding dues.

If you don’t want them to continue hounding you for the overdue money and not worry about getting sued over the debt, ‘debt settlement loans’, also called ‘debt relief’ or ‘debt adjustment’, can help.WHAT IT MEANS BY ‘DEBT SETTLEMENT’ OR ‘DEBT NEGOTIATION’?Debt settlement, also known as debt negotiation, involves wiping out debt by paying a portion of it in one lump sum.

What does a ‘debt settlement’ deal entail for the borrower and lender?

How does the borrower benefit from such a deal? A debt settlement deal can provide the debtor financial relief and put him or her on the path toward rebuilding a damaged credit history.

Meanwhile, a debt settlement loan agreement enables creditors to receive at least some of the money they’re owed rather than no money at all.

Furthermore, it may mean the borrower can avoid filing for bankruptcy. Although, according to some credit experts, filing for bankruptcy may be the better alternative in some cases.

Although it sounds like a good deal, debt settlements can be risky as such loan agreements can irreparably harm your credit.

Moreover, reaching a settlement can take a long time to accomplish, often between two to four years. It can be costly if you use a debt settlement company, because you’ll pay fees. So, it’s a last resort.HOW MUCH WILL A DEBT SETTLEMENT AGREEMENT COST YOU?Once you’ve decided on a debt settlement company, inquire about how much it charges for settling your dues with a loan agreement. However, ensure transparency and see to it that the company doesn’t skirt your queries about costs.

Debt settlement companies typically charge a 15 per cent to 25 per cent fee to tackle your debt; this could be a percentage of the original amount of your debt or a percentage of the amount you’ve agreed to pay.

Let’s say you have Dh100,000 in debt and settle for 50 per cent, or Dh50,000. On top of the Dh50,000, you could be required to pay another Dh7,500 to Dh12,500 in fees to the debt settlement company – which although significant, will seem worth it for those desperate to close their exorbitant loans.

Risks of debt settlement outweigh the benefits

While settling a debt through a debt settlement company could lower your debt amount, get creditors and debt collectors off your back and even help you avoid bankruptcy to a degree, there are risks that may easily outweigh the benefits.

If you are deep in debt looking to settle your loans, a major risk that you fail to factor in is that your creditors may not agree to negotiate or settle with your debt settlement company.

This means that there is no guarantee that the debt settlement company will be able to successfully reach a settlement for all your debts. Moreover, there have been several reports that some creditors refuse to even negotiate with debt settlement companies.CAN I BE CHARGED FEES BY MY DEBT MANAGEMENT COMPANY, EVEN IF MY WHOLE DEBT ISN’T SETTLED?If you stop making payments on a debt, you can end up paying late fees or interest. So while your debt settlement company takes a prolonged time period to negotiate a lower debt with your creditor, fines for late payment will accrue – not to mention countless calls from debt collectors.

Keep in mind that debt settlement companies can’t collect a fee until they’ve reached a settlement agreement, you’ve agreed to the settlement, and you’ve made at least one payment to the creditor or debt collector as a result of the agreement.

But you could still end up paying a portion of the debt settlement company’s full fees on the rest of your unsettled debts, experts reveal. If you have five or six creditors and the company settles one of those debts, they can start charging a fee as soon as they receive a result.

If a debt settlement company settled a proportion of your total debt enrolled with its program, it can charge you that same proportion of its total fee. Let’s say your total debts came to Dh100,000, and Dh50,000 of the total amount was settled, you can be charged 50 per cent of the total agreed-upon fee.

Another key risk: Any delay in negotiating a debt settlement could negatively impact your credit score

A debt settlement company may encourage you to stop making payments on your debts while you save up money for a lump-sum payment.

But at this point, your creditors might not have agreed to anything, which means all those payments you’re missing can wind up as delinquent accounts on your credit reports.

Your credit scores could take a hit as a result of any delinquent payments, and the creditor could also send your account to collections or sue you over the debt.

So coming to a debt settlement loan agreement with a firm that specialises in negotiating them should essentially be one’s last resort. So one should always seek alternatives to debt settlement.

Key takeaways

Before approaching a debt settlement firm, credit experts advise that you should first try negotiating settlements with credit card companies or other creditors on your own. Offer an amount that you can pay immediately, even if it’s less than what you owe.

If you have credit card debt, consider a balance transfer. A balance transfer is when you move debt from one credit card to another, usually to take advantage of an introductory zero per cent interest offer on the new card.

Balance transfer cards have zero per cent introductory rate offers for a specified period of time and may charge a fixed fee or a percentage of the amount you transfer. But check whether you’ll pay more money on the interest payments on your current card than the cost of any balance transfer fees.

And you should also try to pay the balance off before the card’s promotional period expires to avoid paying interest on your balance. There are other debt relief and management options if you cannot get a large lump sum to pay the debt settlement or the credit card company will not negotiate a settlement.

You can take also take debt counselling sessions to tackle this situation. By talking with a credit counsellor, you can explore your options. But if you opt for such settlement services, the debt management programs are structured in a way so as to reduce the Debt Burden Ratio of the borrower.

(Debt burden ratio is the ratio of total monthly instalment or commitments of credit card, loans or any other committed monthly repayments to the total income of an individual.)

Moreover, the negotiating skills of a debt settlement company’s experienced mediators definitely offer an added advantage.