Revenue up 41% as shipping rebound and Navig8 deal drive record year

ADNOC L&S Reports Record 2025 Revenue of $5 Billion, Up 41%

Dubai: ADNOC Logistics and Services (ADNOC L&S) delivered a record performance in 2025, with revenue rising 41% year-on-year to $5.02 billion. EBITDA increased 32% to $1.52 billion, while net profit climbed 14% to $863 million, reflecting stronger shipping performance and contributions from acquisitions. Operating free cash flow surged 42% to $1.42 billion.

The board approved a $325 million dividend for 2025, up about 20% from the previous year, with quarterly payouts and a commitment to 5% annual growth through 2030, subject to approvals.

Shipping Rebound Lifts Performance

Momentum accelerated in Q4, with revenue up 35% year-on-year to $1.19 billion and EBITDA rising 39% to $391 million. Net profit in the quarter gained 29% to $232 million. The Shipping segment reported revenue growth of 122% to $2.13 billion, while EBITDA rose 56% to $619 million.

Captain Abdulkareem Al Masabi, CEO of ADNOC L&S, said: “2025 marked a defining period for the company. ADNOC L&S grew across all segments, diversified into new verticals, and accelerated its international expansion. With the acquisition of Navig8, we elevated ADNOC L&S from a regional powerhouse to global sector leadership.”

The $999 million acquisition of an 80% stake in Navig8 expanded the group’s global footprint to 19 cities and significantly increased exposure to international energy and commodity flows.

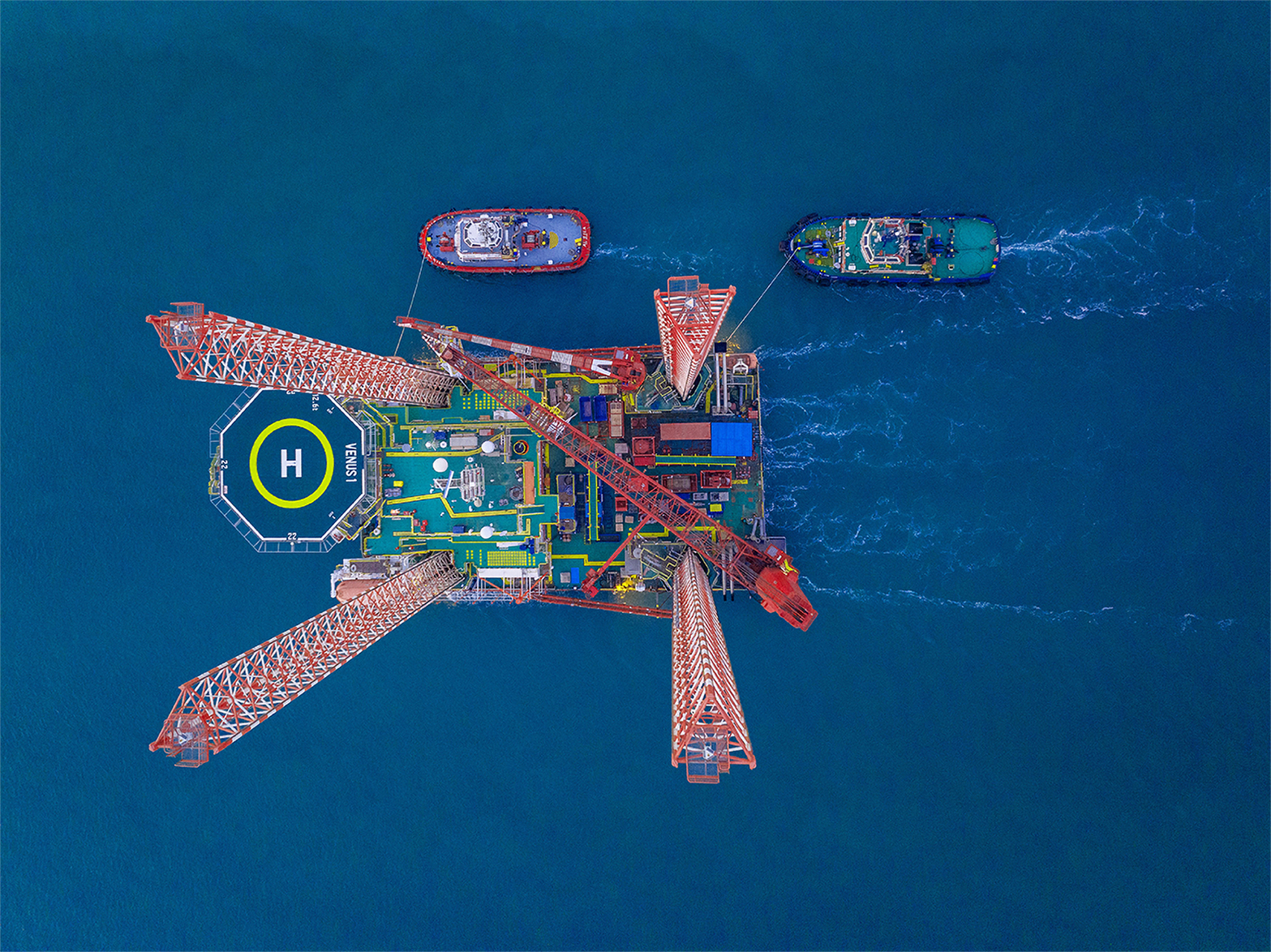

Integrated Logistics, the company’s largest division, generated $2.53 billion in revenue, up 11%, supported by high utilisation across offshore assets and progress on major energy projects. Services revenue rose 16% to $362 million.

Efficiency and Capital Discipline

A Value Efficiency Initiative launched in early 2025 delivered $119 million during the year, surpassing its target. The programme’s contribution target has been raised to an average of $90 million annually through 2030.

Inclusion in the MSCI Emerging Markets Index in November attracted over $240 million in passive inflows and lifted average daily trading value to $19.7 million in Q4. A secondary placement earlier in the year increased the free float to 22%.

Guidance and Balance Sheet Strength

Management expects a mid-single-digit decline in revenue in 2026, driven by the scheduled completion of the G-Island EPC project, while EBITDA and net income are projected to grow in the low to mid-single digits.

The company retains capacity to fund an additional $3 billion of growth beyond announced projects and targets a medium-term net debt to EBITDA ratio of 2.0–2.5x. Subsequent to year-end, ADNOC L&S secured a $2 billion revolving credit facility from its parent, with an option to increase it by $600 million. It also sold a 2017-built VLCC for $111 million, generating a capital gain of $27 million to support fleet renewal plans.