Dubai Airport will overtake the top position in the next 3-4 years due to its persistent upward growth momentum

ubai International airport, or DXB, continues to consolidate its position as the world’s leading hub for international air travel, supported by robust capacity growth and operational resilience. As Emirates and flydubai expand networks, Dubai shows no signs of taking its foot off the gas, according to aviation experts.

Newly released 2026 data shows DXB handled 62.4 million international seats in 2025, widening its lead over major competitors such as London Heathrow and Istanbul. With projections of 96 million passengers in 2026 and a breakthrough to 100 million by early 2027, Dubai is steadily reinforcing its role as a global mobility powerhouse.

In its latest 2025 capacity rankings, OAG underlines the growing global influence of Middle East airports [led by DXB], with the region continuing to outperform pre-pandemic benchmarks and strengthen its role as a critical hub for international travel. “DXB remained the world’s busiest international airport in 2025, handling 62.4 million international seats. Capacity at DXB is up 4% year-on-year basis and 16% above 2019 levels, leaving it 13.5 million international seats ahead of the next busiest airport, London Heathrow,” according to OAG Aviation Worldwide.

In terms of total capacity, which includes international + domestic seats, DXB also ranked as the second busiest airport worldwide in 2025 and continues to close the gap on the top position, currently held by Atlanta Hartsfield-Jackson (ATL). Aviation experts and analysts are of the view that Dubai will overtake the top position in the next 3-4 years due to its persistent upward growth momentum.

“I think the biggest drivers for growth are from the local carriers Emirates and flydubai who have been on a rapid growth trajectory in recent times. With both of those airlines already having large orders placed for new aircraft and deliveries coming this year the airport will continue to see more growth and to your final point could be in a position to overtake Atlanta within the next 3-4 years,” John Grant, Chief Analyst at OAG, told BTR.

DXB’s expanding capacity, record-breaking passenger flows, and technological advancements collectively enhance Dubai’s competitiveness as a global business hub. Whether through rising aviation revenues, increased economic activity, real estate uplift, or corporate mobility efficiencies, the financial impact of Dubai leading the world in international air travel is both broad and deep — positioning the emirate for sustained growth through 2026 and beyond, the experts said.

Strategic location

DXB continues to take advantage of its unique location, covering Europe, Asia, Africa, and the Americas through its global network of routes and its ultra-long-haul network. DXB’s position as the busiest is attributed to its global passengers, who are sustained by Emirates and flydubai airlines operating flights continuously across all continents. Winter growth is attributed to tourism travel from Europe and South Asia, and business class travel showing strength and resilience.

Aviation contributes roughly one third of Dubai’s gross domestic product (GDP), and DXB’s sustained momentum is a key economic driver. Record passenger flows stimulate demand across hospitality, tourism, retail, and ground transportation. With more than 300,000 daily passengers during peak periods, the ripple effect on in city spending is substantial, supporting job creation and bolstering the emirate’s service sector growth.

Saj Ahmad, Chief Analyst at StrategicAero Research, a London-based aviation consultancy, said Emirates’ international network expansion and the allure of Dubai have been the biggest two catalysts behind the 16% growth at DXB capacity since 2019. Similarly, the growth of flydubai too has helped propel DXB as the world’s busiest international gateway.

“Emirates’ growth has come about due its robust and continued product investments across its A380, 777 and now A350 fleets so that passengers get more bang for their buck – and that has been a key reason why Emirates is the worlds most profitable airline too,” Ahmad told BTR.

And since Covid-19 pandemic, he said the return to normality has seen a huge spike in people flying – not just through the UAE and Dubai as a transit point, but specifically travelling to Dubai for a well earned vacation. “The ease of getting around the city, the endless mall and shopping/entertainment options as well as safety make Dubai a go to place for every seasoned global traveller.”

About DXB outlook for 2026 and beyond, he said it is likely that Dubai International will smash through the 100 million passenger mark this year with relate ease. “The airport, despite operating at high capacity, continues to invest in technology and systems to ensure smoother passenger transits and more investment on the ground to ensure operations mean fewer delays and more on time departures,” he said.

“As we race towards the 2032 opening of Dubai World Central / Al Maktoum International – the current DXB airport will easily surpass 110 million passengers through to 2030. As it stands, DXB has capacity for around 120-125 million passengers, so its important that Dubai World Central can onstream on time so that Dubai continues to expand capacity to allow more airlines to have more flights into the city. Of course, this will need to be commensurate with greater airspace access as well, where around 60% of UAE airspace is not fully utilised,” Ahmad elaborated.

In reply to a question regarding DXB can overtake ATL and grab top ranking in international travel, he said: “Absolutely it will. It has already beaten ATL in terms of international traffic. ATL relies heavily on domestic passenger numbers for its totals, but doesn’t handle anywhere near the same amount of international traffic as DXB. Already in January 2026, DXB is on track to beat ATL in passenger numbers. I think by 2027, DXB will surge beyond ATL for that top slot.”

Top 10 Global Airports

Elsewhere in the region, OAG data shows that Doha Hamad International Airport maintains a place in the global top 10 busiest international airports in 2025, reaching 32.7 million international seats. Capacity at DOH is now 20% higher than in 2019, reflecting the airport’s continued expansion and resilience.

“Together, these results highlight the Middle East’s central role in global aviation growth and its continued ability to attract airlines, passengers and long-haul connectivity,” according to OAG.

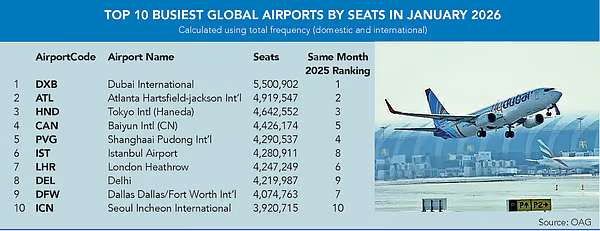

In January 2026, DXB remained the world’s busiest airport with 5.5 million seats, a 4% increase in airline capacity compared with January 2025. ATL ranked second with 4.92 million seats, up 1% year-on-year basis, while Tokyo Haneda (HND) remained in third place despite a 1% decline, totalling 4.64 million seats.

The aviation consultancy OAG said several airports have seen notable airline capacity growth this month. Guangzhou Baiyun (CAN) has 4.43 million seats this month, up 4% compared to last year, maintaining fourth position, while Istanbul Airport (IST) saw strong growth of 6% to reach 4.28 million seats, moving into sixth place. Delhi (DEL) has also performed well, growing 5% to 4.22 million seats and is in eighth place.

“Shanghai Pudong (PVG) saw a 1% decline to 4.29 million seats, while London Heathrow (LHR) and Dallas/Fort Worth (DFW) both recorded broadly stable capacity, remaining flat year-on-year basis at 4.25 million and 4.07 million seats, respectively. Seoul Incheon (ICN) completes the top 10 with 3.92 million seats, reflecting a 2% increase compared with January 2025.

Challenges for international travel

Ahmad said the risk of regional strife is a dark and ever present cloud that may have an adverse impact on international travel, however it is unliklley to affect Dubai International traffic.

“We have seen the recent social turmoil in Iran resulting in closed airspace, forcing airlines to re-route and even cancel flights at very short notice, which of course results in delays for passengers, added costs and uncertainty over when normalcy returns.

“Mercifully, Dubai’s location means that there are plenty of alternative routes into DXB from wherever in the world you fly from, but broader geopolitical issues could also factor into demand for travel given that there is still regional angst in Asia between Thailand and Cambodia as well as India and Pakistan.

“That said, these issues are probably less impactful than we realise given that the biggest challenger for DXB specifically is finding additional capacity within its finite footprint. It can be done, as we have seen since 2019 and its resurgence to growth, but longer term, DXB cannot physically expand and that’s why DWC is an integral lynchpin for the city to remain the GCC and world’s biggest and busiest airport hub,” Ahmad said.